The Increasing Tension Between Iran and S. Arabia and Its Possible Implications for Global Business

Key Takeaways

The present tension between two states poses enormous risks to the regional and global political and economic stability. The organizations should assess the threats and impacts of the possible risks on their internal and external operations.

The Course of Escalation

In the last two years, the ancient rivalry between Iran and S. Arabia became tense due to material and ideational reasons. In this study, we will briefly examine the causes of the problem, its dynamics and possible implications on the global and regional economy.

Both states have a long common history based on rivalry. However, the strain in the relations became more visible in the post 9/11 period through taking a more religious tone.

Some successive incidents stirred up the tension and reinforced the enemy images. In 2011, S. Arabia accused Iran of provoking protest against the Sunni regime in Bahrain during Arab uprising. Later, in 2012, the Shiite communities started demonstrations against the Saudi regime in the Eastern Province of Saudi Arabia. S. Arabia indicated Iran as the actor behind the unrest.

The friction reemerged following the nuclear deal agreement reached within the framework of P5+1 in July 2015. S. Arabia took some measures to decelerate the Iranian oil export by restricting the vessel traffic in the Hormuz Straight. This situation further escalated the current strife between two actors. Finally, the execution of the Shiite cleric Nimr al-Nimr along with forty-six others in 2016 flamed up the existing tension and paved the way for the severing of the diplomatic relations.

The Dynamics of the Confrontation

The present conflict rests on many complicated dynamics emerging from the past and contemporary interactions. Both actors aspire for leading the Islamic world and dominating the wider Gulf region. Therefore, the roots of the confrontation rest on material and ideational factors.

Energy competition and the sectarian difference between Iran and Saudi Arabia constitute the two major conflict dynamics unfolded in many ways. In this regard, the first dynamic is the competition on the share of the energy market.

After the agreeing on the Joint Comprehensive Plan of Action (JCPOA on nuclear deal), Iran started to increase her oil export. This development negatively affected the oil income of S. Arabia, which makes 80% of the government budget.[1] Furthermore, Iran is the second largest oil producer after S. Arabia in OPEC. Thus, S. Arabia concerned that the reentry of Iran in the oil market might weaken her leading position in OPEC.

In this regard, S. Arabia also feared that improving the US-Iranian relations might lead to the Iranian power consolidation and make Iran a more influential actor in the region.

S. Arabia considers the escalation of the tension as a strategy to harm Iranian interests and contain her in the region. Consequently, the present escalation slowed down the external investments[2] in Iranian oil sector and created a quasi-alliance Among the USA, S. Arabia, and Israel. The decertification of the JCPOA and declaration of a new strategy on Iran by President Donald Trump in October 2017 should be considered as the reflection of this cooperation. As a part of the containment policy towards Iran, S. Arabia strives to deepen her relations with Iraq, where a Shia-dominated central government is in power supported by Tehran. Moreover, the interests of Israel and S. Arabia are compatible concerning Iran since she constitutes a common threat for both sides. S. Arabia considers Israel as an ally to ensure the survival of the regime, preserve Saudi identity and curb Shia Iran's influence.

The sectarian difference constitutes the second dynamic of the tension since it plays the major role in the formation of the enmity. Shiite Iran and Sunni (Wahhabi) S. Arabia conflict on some fundamental issues of Islam and parties represent the poles their camps. Thus, each side regards other action as a threat to its spiritual existence. Consequently, the arch-rivals strive to balance another party through various methods including the formation of an alliance with other regional or non-regional actors.

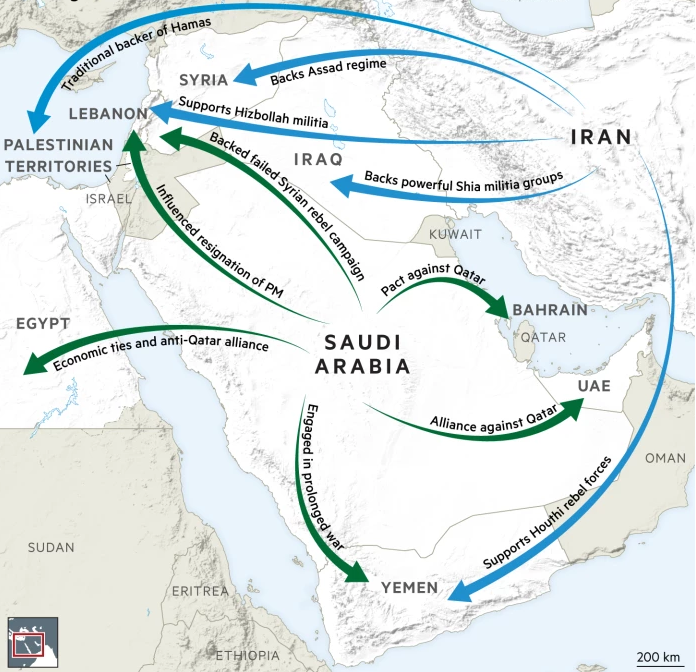

Source: Financial Times

S. Arabia regards Iran's involvement in the Syrian Conflict on the side of the regime as a manifestation of Iranian sectarian ambitions. Thus, S. Arabia feverishly sought to counterbalance the Iranian Influence in the Syria, Yemen, and Lebanon.

In this regard, both sides have been actively supporting opposition groups and conducting a proxy war. In this sense, S. Arabia backed Salafi jihadist militias while Iran supported Lebanese Hezbollah and involved directly in the conflict by deploying Revolutionary Guards Corps to Syria.

According to some observers, Yemen is a scene of proxy war between two actors caused by the sectarian friction. S. Arabia is conducting air offensives on Houthis, who is supported by Iran, to diminish Iranian influence in Yemen.

S. Arabia put heavy pressure on Lebanon concerning Hezbollah, which has been seen as the spearhead of Iranian penetration into the region. S. Arabia considers Hezbollah support to Bashar al- Assad as the Iranian strategic maneuver in the region to strength Shiite Block and open a Shiite corridor ranging from Iran to the Mediterranean Sea.

The cause of the Qatar crisis also rests on the competition between two Antagonists. Qatar's relations with Iran is a key issue in imposing an embargo on Qatar by S. Arabia and some other Arab States even though both states exercised similar policy in providing money and weapons to rebels fighting Bashar al-Assad in Syria.

Bahrain, where a Sunni monarchy rules over a majority Shiite population, constitutes another dimension of the conflict. S. Arabia blames Iran for interfering in the country’s internal affairs and exerting influence.

The Possible Consequences of the Tension

The eruption a war is not a slight possibility due to the strong dynamics of conflict. A war, even an intensified tension, poses a tremendous political risk for the political and economic stability at the regional and global level.

The closure of the Hormuz Strait, where 40% of the world oil exports pass, could create catastrophic ramifications for the world political order, economy and might increase the volatility in the financial markets that could create erratic consequences such as political turmoil and social unrests.

In this context, such development could immediately devastate the both actors’ economy and quickly affect the economy of the Middle East and Africa region. As a result, it could drive some golf states, Lebanon, and Jordan to the brink of bankruptcy and collapse governments as well as trigger a region-wide conflict on the sectarian fault lines. In this situation, additional failed Arab states may emerge which would be utmost detrimental to the stability and peace in the region due to the spillover effects such as migration and terrorism.

Secondly, the escalation could foster Iranian ambition to obtain nuclear weapons, and she can receive support from North Korea, China, and Russia to deter the USA and Israel from involvement.

Thirdly, the adverse economic effects will soon spread out to Europe and far Asia. Accordingly, EU might become more dependent on Russia in oil supply. Considering their 20% share in total oil production, a loss of 20 percent would soar oil prices to the $150-200 / barrel range. Accordingly, those countries, particularly the industrialized states, depending on oil import would suffer the most. This situation might lead to the decline of the world industrial production and would upsurge the commodity prices. The fall of China’s export might put China into recession and create unforeseen societal as well as political consequences in China and the interdependent states.

Fourthly, a possible conflict may also impact on other sectors such as tourism and finance. Consequently, we might see an interruption in logistic supply chain and high costs in transportation.

Conclusions

The rivalry examined above poses enormous risks to the political and economic stability. The risks assessed above are not overrated since they are emanated from the real dynamics and nourished by inflammatory rhetoric of both actors and the USA. It would be wise for the companies operating in the Middle East to assess possible impacts of the political risks on their business.

[1] According to the International Monetary Fund (IMF), Saudi Arabia's financial reserves will be depleted within five years, if oil prices and government spending stays at current levels.

[2] International energy companies took already a more cautious stance towards investments in Iran.